In international commerce, understanding and correctly applying the terms of delivery is crucial to ensure transparency and efficiency in transactions. Two of the most common and important terms are CIF (Cost, Insurance, and Freight) and CFR (Cost and Freight). While they may seem similar, in reality, they have significant differences. Let’s delve into the details to gain a better understanding of CIF and CFR.

Table of Contents

ToggleCIF (Cost, Insurance, and Freight)

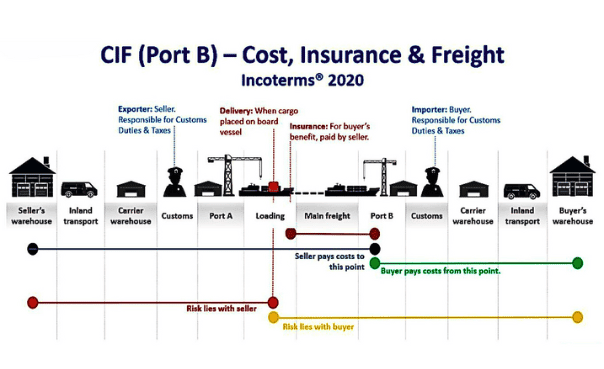

CIF is an international delivery term where the seller is responsible for delivering the goods to the destination port specified by the buyer. Under CIF terms, the seller must pay the freight charges to transport the goods to the destination port along with the cost of insuring the goods during transit. This means that the seller is responsible for the goods until they reach the destination port and are confirmed received by the port.

In addition to being responsible for transportation and insuring the goods, the seller must also provide necessary documentation, including the shipping invoice, export invoice, and insurance documents.

With CIF terms, the responsibility and risk transfer from the seller to the buyer when the goods are handed over to the carrier at the departure port. Consequently, the buyer bears responsibility for the goods from the destination port.

CFR (Cost and Freight)

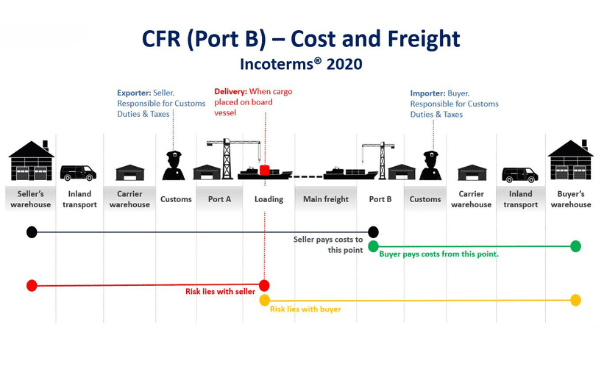

CFR is an international delivery term where the seller is only responsible for transporting the goods to the destination port specified by the buyer. Under CFR terms, the seller only needs to pay the freight charges to transport the goods to the destination port, while the buyer bears responsibility for all costs and risks from the departure port to the destination port.

Under CFR terms, the seller only needs to provide documentation related to the transportation of the goods, including the shipping invoice and necessary documents to confirm the delivery at the departure port.

Comparison of CIF and CFR

| Factors | CIF (Cost, Insurance, and Freight) | CFR (Cost and Freight) |

|---|---|---|

| Responsibility for Transportation | The seller is responsible for delivering the goods to the destination port specified by the buyer. | The seller is only responsible for transporting the goods to the destination port specified by the buyer. |

| Responsibility for Insurance | The seller is responsible for purchasing insurance for the goods during transit. | The buyer must ensure that the goods are adequately insured. |

| Control of Risk | Risk transfers from the seller to the buyer when the goods are handed over to the carrier at the departure port. | The buyer assumes responsibility for the goods from the departure port. |

| Fees and Costs | Includes freight charges and insurance costs. | Only includes freight charges. |

Calculation of Cost of Goods Sold for CIF and CFR

CIF

Formula: Cost of goods sold CIF= Purchase price + Freight charges + Insurance costs.

Notes:

Clearly define the party responsible for freight charges and insurance costs.

Ensure that the goods are adequately insured and documented.

CFR

Formula: Cost of goods sold CFR= Purchase price + Freight charges.

Notes:

The buyer must pay for insurance costs separately.

Understand the responsibilities and risks from the departure port to the destination port.

In Conclusion

In summary, CIF and CFR are international trade terms that dictate the responsibilities and costs associated with delivering goods. CIF places more obligations on the seller, covering transportation and insurance until the goods reach the buyer’s port. CFR, on the other hand, requires the seller only to transport the goods to the buyer’s port, with the buyer shouldering subsequent costs and risks. Understanding these distinctions is crucial for navigating international transactions effectively.