Table of Contents

ToggleDeclining Tuna Exports amidst the Pandemic

The COVID-19 pandemic has significantly affected Vietnam’s tuna exports to various markets. By the end of April 2020, the total value of Vietnam’s tuna exports had reached $196 million, indicating a 16% decrease compared to the same period in 2019.

Despite ongoing efforts, there has been limited recovery observed in Vietnam’s tuna exports. Nevertheless, positive signals have emerged from import markets such as Japan and Egypt, prompting tuna exporters to explore new markets to offset the decline in traditional markets.

Impact on US and EU Markets

Vietnam’s tuna exports to the US market experienced a decline of 36% in April 2020 compared to the previous year. However, the demand for canned tuna in the US market has increased despite the pandemic. This has led to a positive trend in Vietnam’s canned tuna exports to the US, witnessing a 2% growth compared to the same period in 2019.

Vietnam’s canned tuna products exported to the US have demonstrated an upward trajectory and boast the second-highest average price among the top 10 suppliers of canned tuna for this market.

Similarly, Vietnam’s tuna exports to the EU market continued to decline in April. Consequently, the total value of Vietnam’s tuna exports to the EU during the first four months of 2020 decreased by 18% compared to the previous year, amounting to nearly $82 million.

However, there was an increase in Vietnam’s tuna exports to the two largest tuna importers in the EU bloc, namely Germany and Italy. The spike in demand for canned tuna in EU countries, coupled with disruptions in tuna manufacturing plants within the EU due to the disease outbreak, has led to an increased import of canned tuna from outside.

Vietnam’s canned tuna exports to the EU have also shown positive growth, with a 2.7% increase compared to the same period in 2019.

ASEAN and Other Market Trends

While tuna exports to ASEAN experienced a decline in March, there was a renewed growth in April, witnessing a 4% increase compared to the previous year. Notably, tuna exports to Thailand, the largest importer within the bloc, increased by 61%.

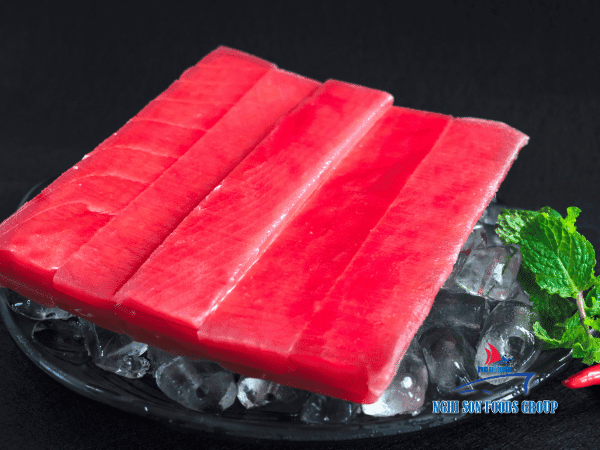

Vietnam’s tuna exports to other major importers, such as Japan and Egypt, continued to rise. By the end of April 2020, Vietnam’s tuna exports to Japan had surged by 36%, and exports to Egypt had seen a notable increase of 59%. Japan’s growing imports of various processed tuna products from Vietnam, particularly frozen steamed tuna meat, have shown a remarkable 111% increase compared to the previous year. Similarly, Egypt has increased its imports of canned tuna from Vietnam.

Stabilization of Tuna Supply and Market Challenges

The supply of tuna materials in the region has stabilized, as evidenced by the approval of transshipment at sea by countries participating in the Nauru Agreement (PNA) and the Western and Central Pacific Fisheries Commission (WCPFC) for regional shipping and fishing vessels in the Western and Central Pacific Ocean (WCPO). This decision aims to ensure a steady supply of raw materials to regional markets, improving the previously challenging situation.

However, despite stabilizing supply, the price of raw tuna remains higher than the previous year and higher than in other regions. This poses a challenge to businesses as it reduces their competitiveness.

Market Outlook and the Growing Demand for Canned Tuna

In the immediate future, with the ongoing progression of the COVID-19 pandemic in major importers, the global tuna market is expected to continue fluctuating. The demand for canned tuna is projected to rise further as consumers seek affordable alternatives. This trend towards canned tuna and pouch tuna products will impact tuna import trends in the coming months. Consequently, businesses must closely monitor the market to make appropriate adjustments and remain agile in response to changing consumer preferences and market dynamics.