Table of Contents

ToggleBoosted by Tax Advantages

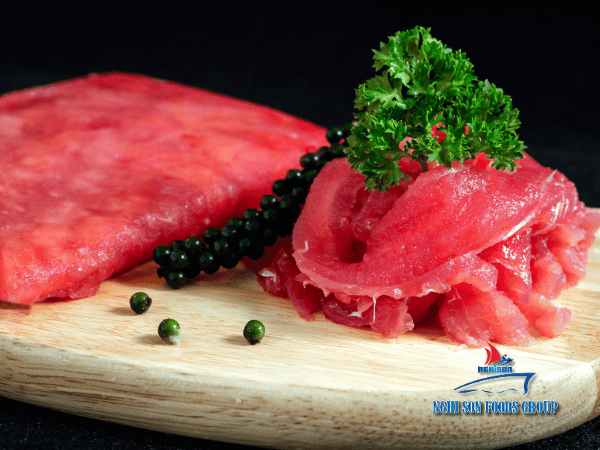

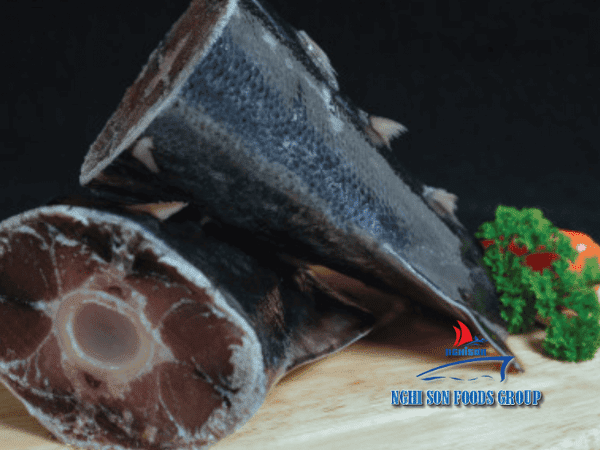

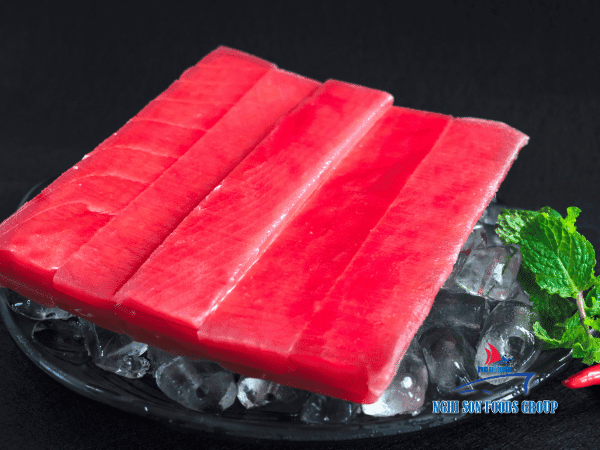

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), ASEAN has become a crucial market for Vietnam’s seafood exports. Vietnamese tuna exports to this region have been increasing, particularly after the implementation of the ASEAN Trade in Goods Agreement (ATIGA) in 2010.

The agreement significantly lowered import tariffs, allowing for favorable conditions that have contributed to the growth of Vietnam’s tuna export industry.

Before ATIGA came into effect, Vietnam’s tuna exports to ASEAN were only valued at $1.6 – $6 million annually. However, since 2010, the export value to this market has experienced remarkable growth. In 2010 alone, Vietnam’s tuna export value to ASEAN increased by 190%, reaching nearly $17.5 million compared to $6 million in 2009. Presently, Vietnam’s tuna export value to ASEAN has exceeded $50 million.

In the long term, ATIGA indirectly enhances Vietnam’s export turnover to non-ASEAN markets by facilitating the import of raw materials at more affordable prices from ASEAN countries. Furthermore, as an ATIGA member, Vietnam gains advantages in trade relations with larger nations, such as eligibility for the U.S. Generalized System of Preferences (GSP).

However, the elimination of tariffs also poses challenges for Vietnamese tuna processing and exporting enterprises. Given the close proximity and similarities in natural conditions and resource exploitation with other ASEAN member countries, Vietnam’s tuna export structure closely resembles that of its counterparts.

While the scale and level of development of Vietnam’s tuna industry are inferior to regional competitors like Thailand, the Philippines, and Indonesia, which also enjoy similar benefits, Vietnam must contend with fierce competition not only in the regional market but also in the global market.

Stable Shrimp Exports and the Path to $1 Billion

Vietnam’s shrimp exports to the ASEAN market, benefiting from preferential treatment under the ASEAN Free Trade Area (AFTA) and related agreements, have remained relatively stable. Shrimp is the third-largest seafood product group in terms of its contribution to Vietnam’s total seafood exports to ASEAN.

From 2008 to 2018, Vietnamese shrimp exports to ASEAN increased from $24 million to $58 million. Although Vietnam’s shrimp export trend has followed a general decline in world markets due to lower shrimp prices and increased supply, the pace of decline in ASEAN has been comparatively slower.

In the first quarter of 2019, Vietnam’s shrimp exports to ASEAN reached $12.7 million, a 10.5% decrease compared to the same period in 2018. Currently, ASEAN ranks as the 8th largest shrimp importer for Vietnam, accounting for 2.1% of the total export value of Vietnam’s shrimp to global markets.

With the advantages of preferential tax rates through trade agreements, ASEAN holds the potential to become a significant seafood export market for Vietnam, potentially reaching a value of $1 billion in the near future. Such diversification would help businesses reduce dependence on key markets.

However, Vietnamese enterprises have not fully recognized this potential and should consider expanding their exports to the ASEAN region, thus reducing reliance on a few key markets.

ASEAN’s Future and Sustainable Market Development

The current main export markets for Vietnamese seafood are the United States, Japan, and China. Notably, China exhibits the highest growth rate and is expected to become the largest importer of tra fish and shrimp in the near future. ASEAN has emerged as a potential market, offering Vietnamese enterprises an opportunity to reduce their dependence on these key markets.

Vietnam has exported products to nine ASEAN countries, with Thailand, the Philippines, and Singapore being the major importers. The establishment of the ASEAN Economic Community (AEC) and the creation of a common market within the region have provided Vietnamese seafood exporters with opportunities to increase their exports to ASEAN.

By 2050, the population of the ASEAN bloc is projected to reach 790 million, significantly increasing the demand for food supply. Seafood consumption is estimated to rise to 37 million tons by 2030, and per capita fishery consumption is expected to increase from 38.4 kg/person/year to 51.5 kg/person/year in the same period. To develop the market sustainably, enterprises must prioritize quality and create added value for their products.