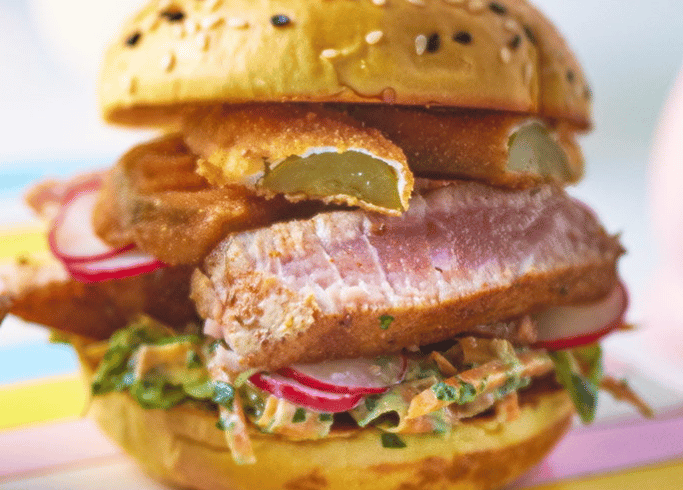

The export of Vietnamese shrimp products to the UK is experiencing a positive trend due to the UK’s promotion of importing warmwater shrimp, which offers an affordable price compared to coldwater shrimp. This shift is driven by the continuous reduction in quotas by major cold-water shrimp supplying countries, leading to a rise in the price of coldwater shrimp. As a result, sales of warmwater shrimp in British supermarkets and retail channels have been increasing, while sales of coldwater shrimp have been declining.

Table of Contents

ToggleGrowing Demand for Warmwater Shrimp

The value and volume of warmwater shrimp products sold in the UK for household consumption have shown consistent growth over the past three years. In the 52 weeks ending on October 6, 2018, shrimp sales reached 31,418 metric tons, amounting to £446.4 million (equivalent to US$571.6 million).

UK: A Key Importer of Shrimp

As the third-largest importer of shrimp products in the EU, after Spain and France, the UK primarily imports shrimp for domestic consumption. Unlike Spain, which imports medium-sized shrimp for both domestic consumption and export processing to other regional countries, the UK focuses on shrimp imports for its local market. Over the past four years, the UK has emerged as a significant market for many Vietnamese shrimp exporting enterprises.

Strong Market Performance

Within the EU, the UK stands as Vietnam’s largest shrimp import market, accounting for nearly 36% of Vietnam’s total shrimp exports to the EU and 6.8% of its total shrimp exports to all markets. In 2017, Vietnam’s shrimp exports to the UK reached US$210.6 million, representing a 55.5% increase compared to 2016. By November 15, 2018, Vietnam’s shrimp exports to the UK had already reached US$212.1 million, showing a 16.4% growth over the same period the previous year.

Vietnam’s Dominance in the UK Shrimp Market

Since 2014, the UK has consistently been one of the top two importers of Vietnamese shrimp. Over this period, Vietnam’s shrimp exports to the UK have experienced remarkable growth, rising from US$114.6 million in 2014 to US$210.6 million in 2017, a nearly 84% increase. As of November 15, the total value of Vietnam’s shrimp exports to the UK had reached US$212.1 million, surpassing the export value for the entire year of 2017.

Vietnam is currently the largest shrimp supplier to the UK, accounting for 26.3% of the total value of British shrimp imports, followed by India with 15.5%.

GSP Tax Incentives and Competitive Advantage

The UK market holds significance for Vietnamese shrimp exporters within the EU due to the Generalized System of Preferences (GSP) tax incentives, similar to the provisions for exporting to the EU. Processed shrimp products originating from Vietnam enjoy advantages in terms of price and quality compared to those from India and Bangladesh in the UK market.

Keys to Success in the UK Market

Given the highly competitive nature of the UK market with rival suppliers, businesses need to have a thorough understanding of the market to provide products that cater to consumers’ preferences. To succeed in the UK market, businesses should offer products at competitive prices, ensure consistent supplies, and focus on continuous product development to meet the evolving tastes of consumers.