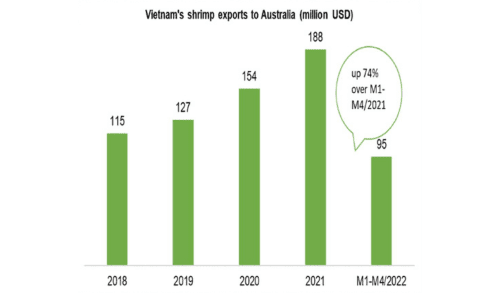

Vietnam has emerged as a significant player in the Australian shrimp import market, ranking seventh in terms of shrimp importers and accounting for 3.8% of Vietnam’s total shrimp export value. After a decline in 2018, Vietnamese shrimp exports to Australia experienced positive growth in 2019.

Table of Contents

ToggleRecovery and Double-Digit Growth

In 2018, Vietnamese shrimp exports to Australia dropped by 4.4% to US$114.7 million compared to the previous year. However, in 2019, after a slow start in the first three months, shrimp exports to Australia rebounded, showing continuous growth from April until the end of the year.

By December 15, 2019, Vietnamese shrimp exports to Australia reached nearly US$121 million, indicating a robust increase of 12.6% compared to the same period in 2018. This growth is particularly noteworthy as it occurred during a time of declining shrimp exports to major markets.

From April 2019 onwards, Vietnamese shrimp exports to Australia consistently grew, with the most substantial increases recorded in July (56%) and November (45%). Australia displayed the highest growth rate among Vietnam’s top ten shrimp importers.

Product Range and Market Competition

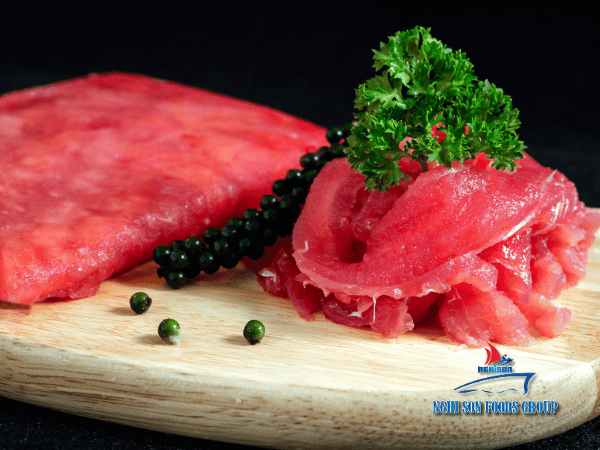

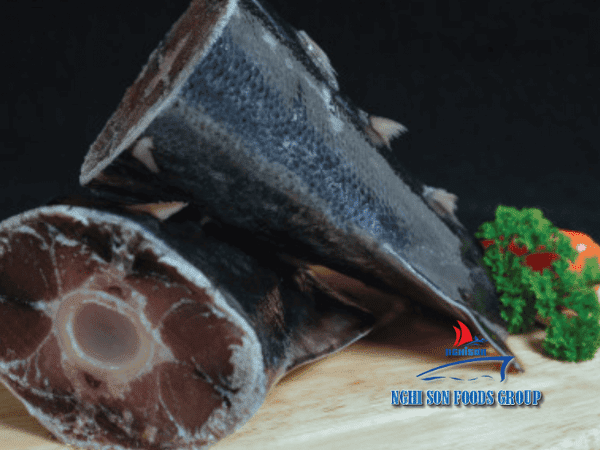

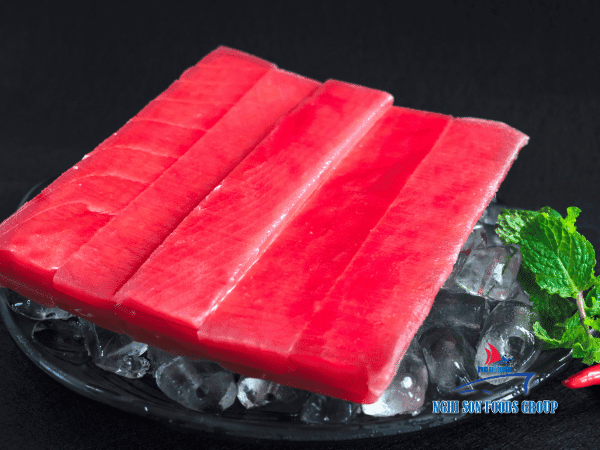

Vietnam primarily exports various shrimp products to Australia, including PD fresh/frozen whiteleg shrimp, frozen whiteleg shrimp (head off, tail on), whiteleg shrimp (head off, peeled), frozen whole whiteleg shrimp, and breaded tempura whiteleg shrimp.

According to International Trade Center data for the first ten months of 2019, Australia’s shrimp imports amounted to US$237.4 million, representing a 16.6% decline compared to the same period in 2018. Vietnam has consistently maintained its position as Australia’s largest shrimp supplier, accounting for 42% of the country’s total shrimp imports.

China ranked second with 23%, followed by Thailand with 22%. Among the top six largest suppliers, only shrimp imports from Vietnam increased by 4.6%, while imports from other suppliers all experienced double-digit decreases. In the Australian market, Vietnamese shrimp faces pricing competition from Thailand, with the average import price of Vietnamese shrimp reaching US$10.1/kg, slightly higher than Thailand’s US$9.3/kg.

CPTPP Benefits and Market Potential

With the implementation of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in early 2019, which includes Australia and Vietnam among its eleven member countries, Vietnamese shrimp exports to Australia enjoy a 0% tariff rate as stipulated in the agreement. This trade agreement has created favorable conditions for expanding shrimp exports to Australia.

Market Preferences and Quality Standards

Shrimp is a highly consumed seafood product in Australia, with an annual consumption ranging from 50,000 to 60,000 metric tons. While farmed shrimp is preferred, an increasing number of consumers are opting for frozen shrimp imported from Thailand and Vietnam.

Additionally, Australian consumers show a preference for larger-sized Vietnamese tiger shrimp.

Australia maintains stringent biosafety, food safety, and quarantine standards, with consumers setting high expectations for product quality. Compliance with these standards, along with trade promotion efforts, the establishment of a value chain for shrimp products, the introduction of new high-value products, and transparent labeling, are critical factors for enterprises to consider when exporting to the Australian market.

Conclusion

Vietnam’s shrimp exports to Australia demonstrated positive growth in 2019, defying the declining trend observed in major markets. With the benefits of the CPTPP agreement, a diverse product range, and growing market preferences, Vietnamese enterprises have opportunities to strengthen their presence in the Australian shrimp market. Adhering to stringent quality standards and consumer expectations will be crucial for sustained success in this market.